Hywind, low economics: The cost of floating offshore wind power

Yesterday, I wrote about the financial travails of the Kincardine Floating Windfarm and the eye watering bill that is going to have to be paid for its construction. The cost of floating offshore wind power is, it seems, going to be high.

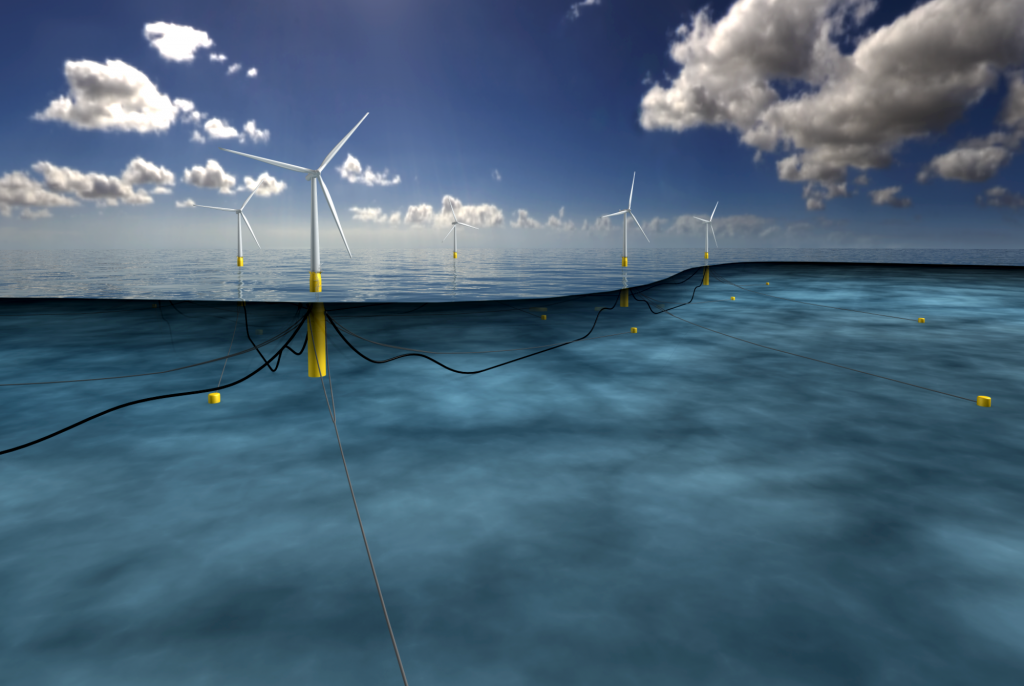

I thought it might be interesting to look at Hywind, the UK's first operational floating windfarm, which started production back in 2017. Floating windfarms are thought to be a good idea for two main reasons. Firstly you can park them where-ever the wind is best; that means you should maximise production. It is also argued that operating and maintenance costs should be lower; instead of having to deliver crew and parts by boat or helicopter, you simply tow a broken turbine back to port and fix it there.

Let's see how Hywind is doing. The windfarm is aptly named, because, parked 20 miles off Peterhead, it has been delivering load factors (that is, the percentage of theoretical capacity) of over 50%. That's better than even the best fixed windfarms, for which you might expect a figure of around 45%.

Unfortunately, according to Hywind's most recent accounts, this improved performance comes at a cost. At £264 million, its paltry 30MW of capacity cost its backers £8.8m per megawatt. This compares to £3.5m for fixed offshore wind (which operates at much lower load factor) , and £0.6 million for gas turbines (which can operate at much higher ones). So the projects backers are paying three times the price of fixed offshore wind, for marginally higher output.

Meanwhile, the operating costs are either disappointing or disastrous, depending on your view of the world. A fixed offshore windfarm like Rampion - of similar vintage to Hywind - has operating costs of around £150,000/MW. On that basis, Hywind's £200,000 per megawatt is very disappointing. On the other hand, renewables advocates claim that the true operating costs of fixed offshore wind are well below £100,000/MW. If that's the case, and floating offshore is supposed to be cheaper to maintain, then Hywind's performance could be seen as a disaster.

All this means that the underlying economics of the project are appalling. Hywind only managed to clock up £5 million of electricity sales, and its underlying position is a loss of £15 million or so. Still, the developers will not be overly worried; subsidies from the government brought in another £29 million of income, and so they are sitting pretty on a profit of £13 million.

Why would they care about their operating costs?